The announcement of the Allergan acquisition of MAP Pharmaceuticals for nearly $1 billion (and the NuPathe approval) is a good reminder of the potential value (both clinical and financial) of reformulation and drug delivery approaches to product development.

Now there no question that new pharmacologies are needed in just about all therapeutic categories. Unmet needs continue to persist in asthma, pain, oncology, and other areas. And we salute the efforts of university researchers, start up companies, and their financial backers to discover and develop new pharmacologies and new products.

However, there still is a role for taking an “old” established molecule and reformulating it in order to develop a product that is safer and/or more effective.

In fact, there will always be a need and demand for the drug delivery/reformulation approach as long as:

- There is a need for new pharmacologies (see above)

- There are drugs with solubility problems

- There are drugs with half lives that are too short

- There are drugs with half lives that are too long

- There are drugs with other PK issues (e.g., rapid absorption, poor absorption, erratic absorption)

- There are drugs with toxicity issues (e.g., paclitaxel)

- There are drugs where site specific delivery makes sense (respiratory, ophthalmology, etc.)

Get the picture?

Unfortunately, there is very little press coverage around companies and technologies who are in this space. MAP may be an exception, but their coverage of late has been more about their FDA issues and not their technology.

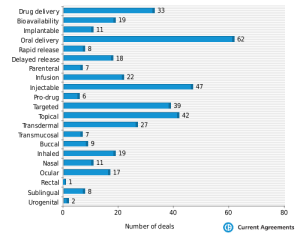

Yet just last week, a good summary of the drug delivery deals in 2012 was published by Dan Stanton. Three items stand out from his report:

- There continues to be an emphasis on altering oral delivery profiles in order to improve compliance. Now we know that there are many who believe this is not “innovative.” Yet the fact remains that better compliance results in better efficacy. Isn’t that the goal of the drug in the first place? Similarly, the demand for parenteral delivery technologies, including needle-free systems, remains quite strong.

- Oncology and CNS are two of the leading therapeutic areas where drug delivery/reformulation deals are taking place. This is no surprise, given the unmet needs and lack of novel pharmacologies in both of these areas. The recently approved NuPathe patch for migraine is a great example of this. After all, when a migraine patient experiences nausea and vomiting, how are they (especially needle-phobes) supposed to swallow their migraine medicine?

- We were pleasantly surprised by the number of Preclinical drug delivery deals in 2012. Historically, drug discovery groups were loathe to introduce a drug delivery technology early in development, preferring instead to synthesize their way out of a particular problem. However, many companies are (finally) realizing that a formulation approach could rapidly solve solubility or other issues, thereby enabling the introduction of the candidate into the clinic that much faster. Yes, the innovator will incur licensing fees and some Royalties if the candidate ever makes it. However, that can be a small price to may when the alternative is the cycling through candidates in Preclinical testing.

So 2013 will likely be another good year for drug delivery business development licensing. The conditions that spur demand for drug delivery (listed above) are not going away anytime soon.

Related articles