Yesterday, North Carolina-based Pozen gave a detailed Investor Update, focused

on PA32540, a “Coordinated-Delivery Tablet Containing Enteric-Coated Aspirin and Immediate-RElease Omeprazole.”

Information on the company’s pipeline is available here, while the investor presentation (lengthy PDF) is here.

At Lacerta Bio, we follow the drug delivery/reformulation space quite closely. We happen to have a lot of experience in this space. Plus, we believe that there can be a lot of therapeutic value gained from these approaches, especially if this therapeutic value can be achieved using an efficient development plan and reasonable drug pricing.

So with PA32540, it appears that Pozen has really latched onto this second point (reasonable drug pricing). But first, a little background…

There is no question that aspirin is a valuable agent to prevent cardiovascular and cerebrovascular events. However, as Pozen points out, nearly 70% of patients who should be on aspirin therapy are actually taking it. So even though aspirin is very cheap, the side effects make long-term aspirin therapy prohibitive for many patients.

In fact, Pozen’s clinical data support this. They demonstrated that nearly 12% of their subjects on enteric coated aspirin experiences gastric and/or duodenal ulcers. Further, over 11% of subjects discontinued enteric-coated aspirin due to any adverse event.

Now that’s not to say aht PA32540 is perfectly safe either. For example, Pozen’s own data demonstrate a 17.5% incidence of gastritis, versus 16% for enteric coated aspirin.

Nevertheless, the safety data, coupled with the well-established efficacy data supporting aspirin in this population, make PA32540 a compelling product.

But what about cost?

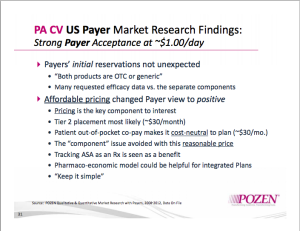

As one would suspect, Payers responded with little enthusiasm when initially presented with the PA32540 profile.

What changed their minds?

$1

Pozen correctly noted that pricing is the key component to having a successful reformulation product.

Specifically, at $1 a day, this makes PA32540 cost neutral to the Payers. Even better, the product will likely be on Tier 2 on the formularies, instead of Tier III.

Brilliant.

In fact, since Tier II copays are around $30 a month anyway, a contracting approach will likely not be required.

Now stop and think about this for a second. Let’s suppose you currently sell a branded product in a category where there are generic alternatives (statins, for example). With a generic available, the brand would have to have compelling clinical evidence of superiority to have Tier II pricing, and even that will be a challenge.

The way many companies handle this is through bundling a basket of products, offering different prices on the products in a basket in order to make that branded Tier III product more compelling for the Payers.

So while a Pfizer or an AstraZeneca can do this, a small company without a substantial portfolio of products cannot.

This is critically important from a business development perspective (and hence another reason why we’re so interested). Time and time again we see plans and business models which do not have substantive payer research supporting the model. There is a real danger that products can be approved, yet fail miserably in the marketplace, partly due to unreasonable pricing and revenue expectations.

The “Affordable Medicine” concept Pozen is supporting can really resonate with a number of Payers. Importantly, if a developer can execute on a plan while maintaining an Affordable Medicine mindset, and not the Wall Street/Investor-driven blockbuster mindset, then we may see more approved products on the market, with broader usage for each product.

Further, by moving aspirin from OTC to Rx, we will now have a much better tracking system for aspirin prescribing, usage, adverse events, etc. Again, this is another way the entire system benefits from their approach.

We can’t say whether or not Pozen (or their commercial partner) will hit their Revenue targets. We dont’ even know if Pozen will successfully out-license this asset to strong commercial partners. However, given some of the plans we’ve seen recently, we have to commend Pozen for their pricing and commercial strategy.

Related articles