Source: Nature Biotechnology, 32, 617–619, (2014), Published online 08 July 2014

Our good friends at Venture Valuation published an interesting study in the July issue of Nature Biotechnology.

In the study, the authors address an interesting question, namely, do small-to-medium sized enterprises (SMEs) receive more lucrative deals from Big Pharma compared to other SMEs?

Now at first glance, it might seem like an obvious answer.

Big Pharma has more money. Therefore, they can and will pay more.

However, as with most things, it’s far more nuanced than that.

We encourage you to check out the article for their analysis, as we won’t steal their thunder here.

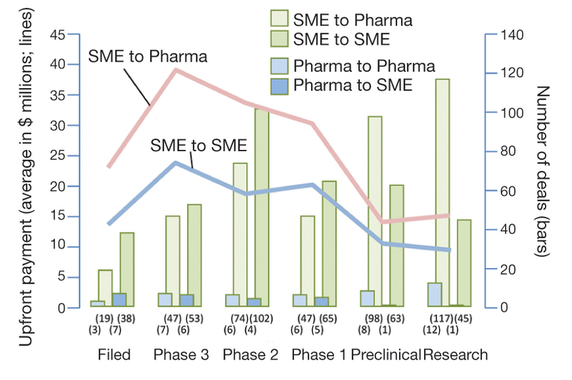

However, one interesting statistic from the study is that out of 833 in-licensing deals in their database (which runs from 1996-2013), only 66 deals (8%) involved big pharma out-licensing internal products either to other big pharma (42/66) or SMEs (24/66).

Only 8%!

Looking at that data more closely, we see that Pharma to Pharma out-licensing has been more common at the Research stage (12/42), then Preclinical (8/42). Pharma to Pharma out-licensing at the Filed stage (3/42) is comparatively rare.

Interestingly, the pattern is reversed in the Pharma to SME data. Pharma to SME out-licensing at the Filed stage (7/24) is more common than the Research stage (1/24).

Now this can be explained by the fact that Pharma would rather out-license a Research-stage asset to a “colleague” to shift development risk, until such time as the asset is de-risked and a future co-development or marketing deal can be struck. Similarly, a Big Pharma company is unlikely to find an SME with the capital required to develop an NCE through commercialization.

It would be interesting to explore these data over time. For example, are Big Pharma more willing to out-license or divest assets in this environment, compared to the 1990s?

These data also strike us as interesting because there are a number of companies (we now you’re out there…) who are seeking “underperforming” on-market assets from Big Pharma.

These data support the notion that it is not an easy thing to do.

Why is Big Pharma unwilling to part with their brands, even if they are underperforming?

That’s an issue we’ll deal with in a future post.