We’re late to the this party, but HBM Partners issued their two annual reports on M&A Activity and New Drug Approvals. Both reports also have Excel files with raw data for analysis. Below are a few highlights which caught our eye:

M&A Activity – By numerous measures, 2015 was a record year, especially in terms of volume, transaction size, etc.

- Transaction volume in the US was $195.9 billion in 2015, up from $90.1 billion in 2014. Interestingly, EU transaction volume declined from $50 billion to $20 billion during the same time period (See Chart 1).

- Transactions with >$1 billion upfront jumped from 14 in 2014 to 21 in 2015 (and way up from 4 in 2013). Nineteen of the 21 deals were for US companies (See Charts 3 and 4).

- Transaction values for the acquisition of VC-backed companies continued to rise, reaching an Average Total Transaction Value of $667 million in 2015, up sharply from the $420 million mark in 2014. In fact, these values have been rising steadily since 2010, reflecting Acquirer presence for paying more for later stage, less risky assets. Interestingly, Average Invested Capital has steadily declined during this same period (Chart 10). Oncology continues to be the largest contributor to this trend (Chart 12).

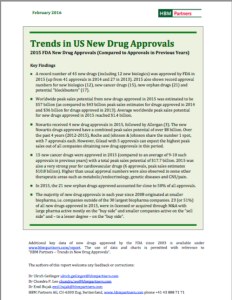

New Drug Approvals – A record year, to be sure:

- Forty-five NMEs were approved in 2015, up from 27 in 2013 and 41 in 2014. That’s a new record for the FDA and our industry. HBM projects Worldwide Peak Sales exceeding $57 billion from these NMEs.

- Fifteen of these NMEs were for cancer indications, followed by Cardiovascular (6), Diabetes/Metabolics (5), and Genetic Disorders (5).

- Sixteen of these NMEs were “First In Class”, same as in 2014

- Interestingly, 22 out of 45 (48%) can from in-house development (which we assume means discovery and development). Of the rest, 12/45 were in-licensed, and 11/45 were acquired through M&A.

What Does This All Mean?

- Our industry continues to innovate, yet we continued to be battered in the media. This has to stop.

- Companies seeking licensing partners should always remember that Big Pharma prefers certain indications, and certain levels of asset maturity.

- While reports like this do a good job of aggregating large, public deals, there are undoubtably an unknown number of deals which may seem small, but are nonetheless important to those shareholders. Keep this in mind as you read reports like this.