Last week, the US Centers for Disease Control published a rather alarming report on drug overdose deaths in the US.

Here are a few items which we found surprising and/or interesting:

On The Rise – Age-adjusted drug overdose deaths have steadily increased since the late 1990s. But now we’re seeing “hockey stick” growth from ~2012 onward, especially in Men.

Older Patients/Victims – Alarmingly, adults 55-64 years of age has the largest increase in drug overdose deaths. So we’re not talking here about kids getting their hands on illicit drugs.

These are likely patients suffering from chronic pain who are becoming addicted, then dying, from their pain meds.

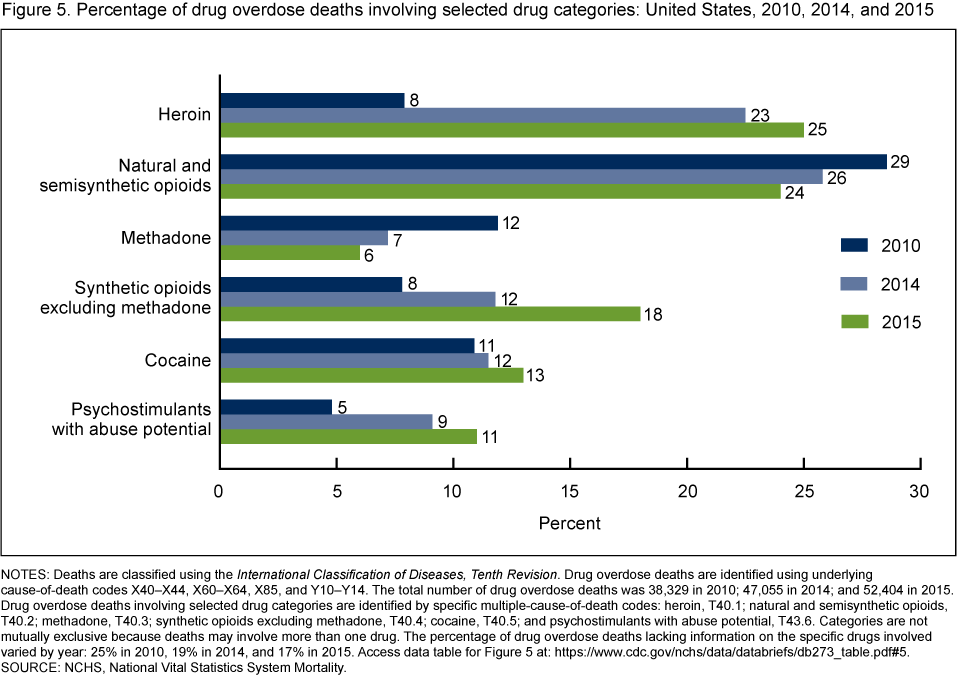

Rx – While deaths from heroin overdose are increasingly rapidly, it’s the opioids (both natural and synthetic) that are the primary cause of these deaths. Deaths attributed to fentanyl are increasing at an especially alarming rate.

Some analysts suggest that chronic pain patients addicted to opioids are turning to heroin in order to feed their addiction.

*~*~*~*~*~*

What Has Pharma Done? What Else Can Pharma Do?

To its credit, our industry has not shied away from this problem. Indeed, the sheer magnitude of the problem means there are substantial commercial opportunities for companies. For instance:

Deterrence – Formulations with built-in deterrence mechanisms continue to make their way into the market. But, the CDC data suggest that these products have failed to make a dent.

Naloxone – We now have naloxone available in auto-injectors and nasal sprays, which are good concepts for the rapid administration of an “antidote” in emergency situations. Indeed, police and firefighters are now being trained on how to recognize opioid overdose and administer naloxone even before paramedics arrive on a scene. Pharmacies will also play a front line role in the use of naloxone in the emergency setting.

However, the high cost of these products may be problematic. Rapid-acting, low-cost naloxone products may be a good opportunity for the right company with the right delivery technology.

Educate – Neither pharma companies nor prescribers want to bear the responsibility for these tragedies. Indeed, like the gun industry, pharma companies like Purdue are taking a very active role in educating and supporting prescribers on the proper use of opioid medications.

Innovate – There is a palpable increase in the discovery and development of candidates which can provide pain relief via non-opioid targets. More, please.

NSAIDs Revisited – What if we said that 200 mg of oral ibuprofen is nearly as effective as 10 mg intramuscular morphine? Sounds counterintuitive, right? Of course. Yet, there is ample evidence to support the idea that NSAIDs, especially in certain combinations, maybe just as effective as opioids in the post-op setting.

Now, we know NSAIDs have their own problems, especially in the chronic pain setting. However, unique combinations with unique PK profiles may be a great alternative, especially if extended market exclusivity is granted to these kinds of products.

*~*~*~*~*~*

Future Challenges

Reimbursement – Let’s face it. Reimbursement is generally quite poor for combinations of older drugs. Undoubtably, the deaths and near-deaths are causing increases in medical costs being born by the insurance companies. More favorable reimbursement policies in favor of the products and technologies mentioned above could save the system money in the long run.

Prescriber Habits – It can be difficult for prescribers to change their prescribing regimens. And who can blame them? Once a physician feels comfortable prescribing a limited number of drugs, it makes sense for them to continue to do so. And there are definite roles for opioids in the treatment of chronic pain.

But, now may be the time for physicians to rethink their habits, especially if they are clinging on to old paradigms such as the WHO pain ladder (which was designed for cancer pain, by the way).

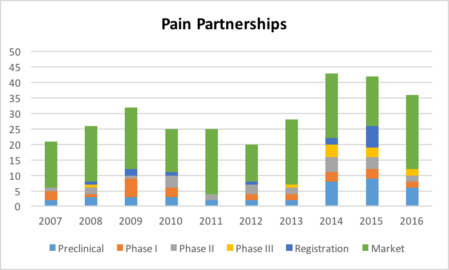

Partnerships – Dealmaking in the Pain space has grown at a modest ~6% over the past 10 years. But, the transactions to date are biased towards Marketed products. Will the industry embrace this problem as a commercial opportunity and engage in earlier-stage licensing?

Transactions in the pain space have increased, especially since 2010. However, the bias has been towards Marketed products. Will this change? Source: MedTrack.

In summary, there appear to be ample opportunities for industry and government to:

Recognize the problem through additional data, education, and rational press coverage; and

Do what it can to address the problem via regulation, education, and innovation; and

Generate financial returns by developing and commercialize novel products.