Is out-licensing difficult?

Yes, of course it is.

But how difficult is it? Is this something which can be quantified? And, why would we want to quantify this anyway?

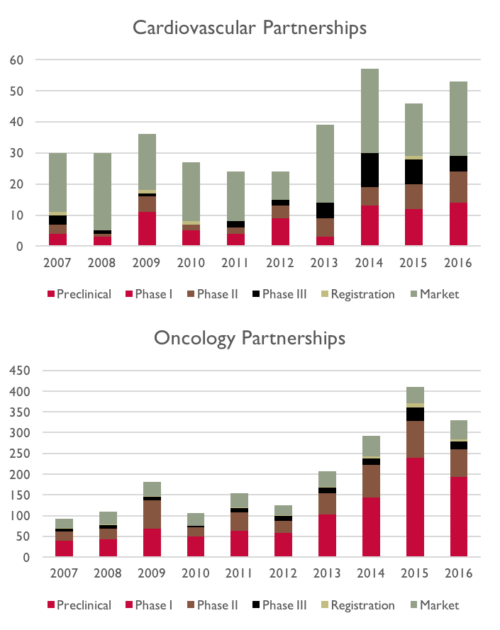

These data from MedTrack show Partnerships in two therapeutic areas over time, by stage of development.

Now we recognize that these data may have some issues.

For example, it is possible that a single transaction could result in multiple press releases. Are there duplicate press releases in these data? We don’t know.

But, for purposes of discussion, let us assume these data are largely correct.

Two things stand out from these data.

The first is that the number of partnerships has grown, from a low in the 2010-2012 timeframe, up through 2015-2016.

This makes sense, as more and more companies are externalizing their research and development.

What is also notable is that therapeutic areas “prefer” partnerships at different stages of development.

For example, oncology partnerships tend to be for earlier-stage assets, while cardiovascular partnerships tend to occur with later stage assets.

Similarly, there are far fewer cardiovascular partnerships versus oncology partnerships.

Again, this makes sense, and is consistent with what we read in our industry press.

So why is out-licensing difficult, if the general trends are working in our favor?

Swimming Against The Tide

Trying to outlicense an asset at a stage of development and in an indication which does not match what the broader industry is looking for is difficult.

It is not impossible, but it is difficult.

For example, in 2016, Arrowhead Pharmaceuticals executed a license and collaboration agreement with Amgen for an RNAi drug candidate in the cardiovascular space.

That was one of ~10 cardiovascular Preclinical partnerships which took place in 2016.

However, according to MedTrack there are roughly 5,000 cardiovascular candidates in development. Of course, some of these are within large multinationals, and are not really available for out-licensing.

But nevertheless, many of these candidates, especially the more advanced ones, are competing for attention against the few preclinical candidates which are available.

So what are the odds? One in 500? One in thousand? Be our guest.

Crowded

If you want to out-license a Preclinical candidate, you are better off with one for an Oncology indication. Preclinical oncology partnerships occur far more frequently than Cardiovascular ones, by a very wide margin.

But, that is an amazingly crowded market. Over 50% of the 300-400 Oncology partnerships involve Preclinical assets.

What can we do?

While the odds can be high, the odds are not zero. Therefore, we need to do all we can to present our opportunities with the best, clearest, most interesting language we can.

This is precisely why throwing together a 15 slide presentation a week prior to a conference rarely works well.

Having a series of connected, well-developed presentations, each serving a specific purpose, may not guarantee a partnership.

But paying more attention to how we communicate can only help move from planning to that initial meeting, and then the second meeting, and then the CDA, and so forth.

Our advice is simple…

- Be ruthlessly critical of your slides, presentations, and text you use in emails and meeting invitations.

- Prepare presentations well in advance, as in weeks in advance.

- Rehearse live presentations out loud, preferably with trusted colleagues. Where are the fumbles and stumbles taking place? What is not clear? Which slides are just too busy?

To learn more about how to develop and improve your out-licensing presentations, join our “Buzz Session” in Berlin on Wednesday, November 8.