Last week was the 20th anniversary of the launch of Viagra (sildenafil, Pfizer). Formerly known as UK-92,480, sildenafil was first synthesized at Pfizer’s faculty in Kent, UK. The press is having a good time writing terrible jokes about this, and we will not acknowledge them further.

However, years from now, historians documenting our industry’s history will likely devote at least one chapter in their tomes to the development and commercialization of Viagra.

Why? Here are a few reasons.

New Industry Created

First, Viagra (and, prior to that, Rogaine) created an entirely new market…prescription medications for non-medical, or cosmetic, or ego-driven indications. Frankly, none of these terms describe this market well.

But, regardless, products like Viagra and Rogaine (coupled with DTC marketing) drove “patients” into physicians offices, resulting in billions in sales for Pfizer.

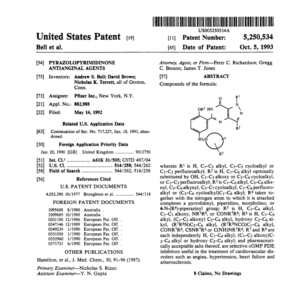

Remember, these are products which have to go through the standard drug development process…Preclinical studies, Clinical trials, CMC, Regulatory filings, patents…everything.

Can you think of any other “consumer” product that has to go through this much development?

And, for a cash market?

We can’t.

This was perfect timing for the company, as they were already beginning to suffer from revenue losses from their Procardia franchise.

The idea of a patient/consumer proactively seeking a physician appointment for a non-medical concern is not out of the ordinary today.

Indeed, critics of direct-to-consumer advertising speculate that this behaviour is resulting in the overuse of certain drug classes, such as drugs to treat flu-like symptoms.

Interestingly, Viagra and its competitors continues to drive men into physicians offices, where concerns about erectile dysfunction are, in turn, increasing the early diagnosis of prostate issues and diabetes.

Let’s face it. Most men are too stubborn or bashful to have these frank discussions with their physicians. But if the promise of a more active lifestyle can be had simply by taking a little blue tablet, then these men will proactively seek medical advice, which can only be a good thing in the long run.

Pivoting

Consider the following scenario.

The CEO of a small biotech company is presenting to his or her Board, which consists largely of investors.

The CEO is proposing the following:

- Stop all clinical development for the lead drug candidate in well-established cardiovascular markets; and

- Conduct a new set of clinical trials for an indication which is potentially very large, but not well established, and in which a few approved drugs already exist (cf., Caverject, etc.)

How would the Board react?

Or, to put it another way…what are the chances of that CEO losing his/her job that afternoon?

The point here is that massive pivots from one therapeutic area to another may only be possible within large (arguably, very large) multinationals.

Pfizer management deserves some credit for making this decision. It would have been relatively easy to continue developing sildenafil in angina and related conditions.

Arguably, the clinical data were not that strong, and sildenafil would likely have been relegated to niche indications in the cardiovascular market anyway (if it was ever even approved for angina). And, let’s face it, clinical observers were fortunate that Phase I volunteers were surprised by the rather unexpected and pleasant side effect.

Regardless, the decision to pivot into a tiny, unestablished market in which the company had no presence took courage.

Migration to OTC

As of last month, Viagra is available without prescription in the UK as the 50 mg strength. As generic versions of sildenafil become available, it is likely that other countries will follow suit.

It will be very interesting to see what happens once sildenafil becomes available in the US without prescription.

This will also trigger the commercialization of alternative dosage forms, such as rapidly dissolving tablets and films…some of which are already on the market in certain countries.

The migration of a drug from Rx to OTC is obviously not new. Loperamide is another example of a drug which was originally a controlled substance, but is now available without prescription.

Why is this important?

Incredibly, there are a number of non-prescription brands which generate hundreds of millions of dollars global sales. Examples include Nexium ($2,032 billion), Voltaren ($626 million), and Aleve ($460 million).

What can Viagra achieve as a non-prescription product?

It makes sense that gastrointestinal and mild pain are leading indications for OTC products. One would expect ED to be a smaller market.

But will it?

Who will not want to use it? Aside from men with genuine ED, there will be casual users, curious teenagers, and even women.

Could Viagra be the first $5 billion OTC product?

Possibly.

Counterfeiting

Years ago, I attended a seminar by a representative from the US FDA. His talk was on counterfeiting. I will never forget the pictures of the hand-cranked cement mixer with blue paint on the inside and the edges.

Why the blue paint?

The blue paint was there because the owner of said cement mixer was using it to coat counterfeit Viagra tablets.

Counterfeiting in our industry, to some degree, was already a practice before Viagra. Film noir fans will already recognize know this.

However, it is probable that counterfeiting increased manifold once Viagra was launched. We don’t have any data to support this statement. Be our guest.

In conclusion, let’s tip our hats and raise our…glasses to Andrew Bell, David Brown, and Nicholas Terrett.

These scientists and their management at Pfizer essentially created the consumer-driven pharmaceutical industry that we know today.

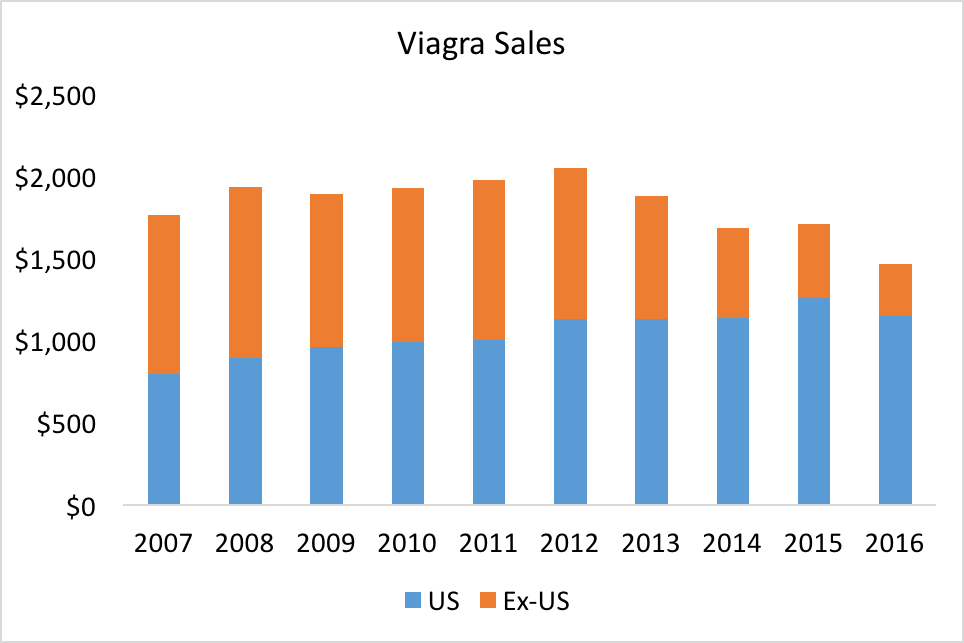

We acknowledge Scott de la Sierra and his team at MedTrack for supplying historical sales data and context.