Odd question, isn’t it?

Yet, with all the talk of China these past few years, it almost seems as if we have forgotten about Japan.

Has the Japanese pharmaceutical industry lost its share of voice in the pharma licensing community?

We do not think so. In fact, recent events could make Japan an even more attractive option for companies looking to partner early-stage drug candidates.

Strong Presence at BIO

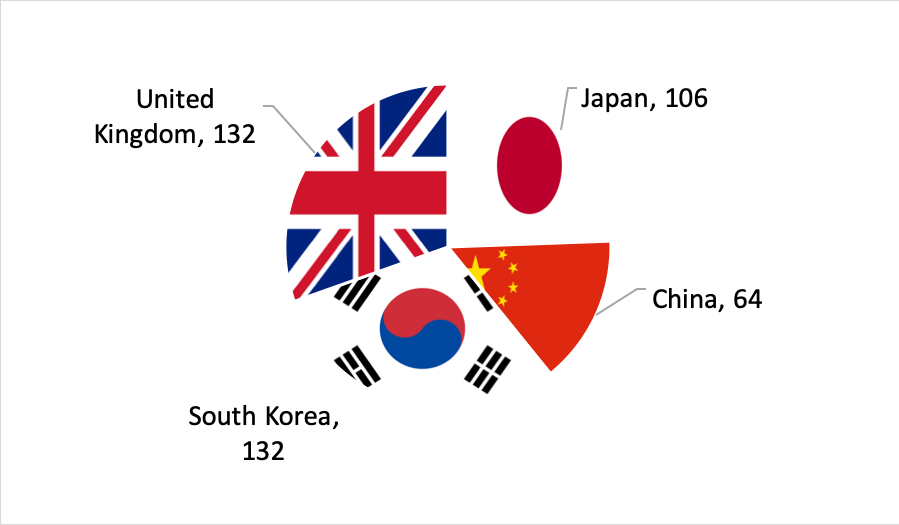

At the recently-completed BIO convention in Philadelphia, Japanese presence was strong, and on par with countries like South Korea and the United Kingdom. Over 100 Japanese companies were in the Partnering system:

Deal Volume

According to MedTrack, partnership deals in Japan have increased steadily over the past 10 years, increasing roughly 3x over the past 10 years. These data exclude grants, CRO agreements, and the like.

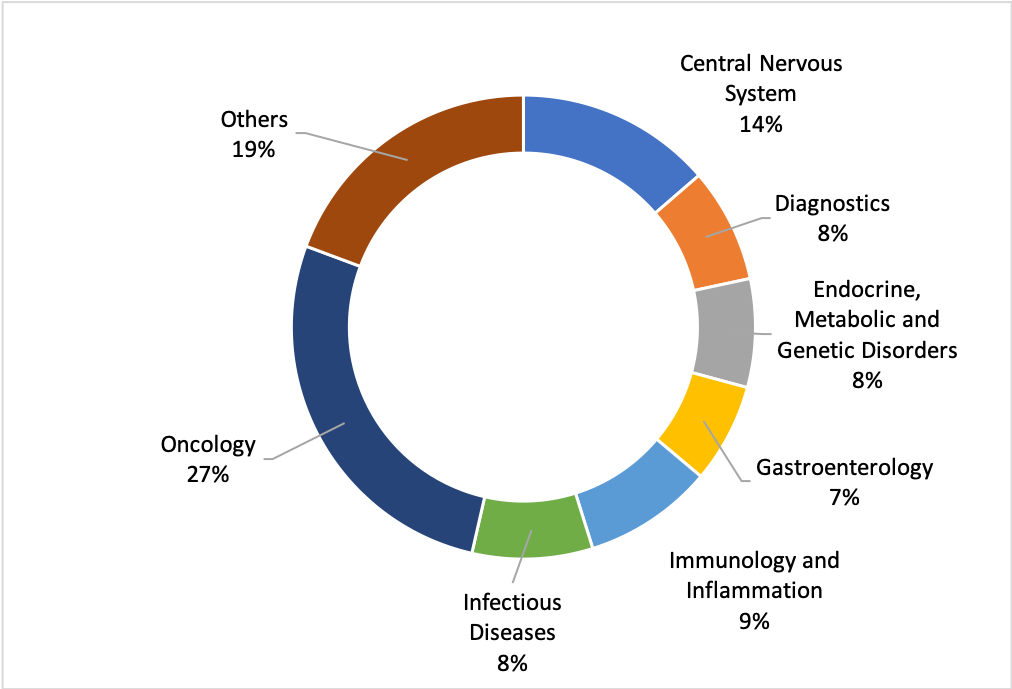

As seen in many other countries, Oncology partnerships account for roughly a third of all deal volume in Japan.

While the trends are positive, a “seismic shift” occurred in 2018 which may accelerate in-licensing by Japanese companies in the years to come.

The Shift

In his first of a series of articles on the Japanese pharmaceutical market, Tosh Nagate from e-Projection discusses recent trends and changes in the pricing of pharmaceuticals in Japan. Anyone with an interest in learning more about the Japanese pharmaceutical market is encouraged to read this short, but highly informative series.

In summary, Dr. Nagate points out the following:

Pricing – Prices for pharmaceutical products has declined significantly over the past few years, and this trend will continue.

Impact– For the first time in industry history, some domestic pharmaceutical companies will exit the market, either through divestment or even bankruptcy. In a country known for companies lasting for decades, this is unprecedented. More companies will likely follow.

Hence, The Shift– Many Japanese companies will have to make the classic Porterian strategy decision; Compete on price/volume, or innovate? For companies that choose innovation, it will mean more scouting and more in-licensing…and this is actually good trend for the industry as a whole.

Yet, Japan has the reputation for being a complex market from a development and pricing perspective. But, as Dr. Nagate points out in his article, the Japanese authorities continue to simplify their procedures to promote innovation, including the development of pricing schemes and approval processes which encourage innovative new products. For example, median times to approval in Japan were 311 days in 2015, versus 422 days in Europe and 333 in the US.

What About Pricing?

Interestingly, Japan base their prices on cost structure, permitting innovators a certain profit margin. Thus, products which are expensive to manufacture and deliver are available in Japan, with pricing that enables innovators to still generate a profit margin.

For example, Kymriah was recently approved in Japan at a price of $306,000, slightly lower than US pricing, but not orders of magnitude lower.

A quick look of prices shows that Japanese prices tend to be lower than the US, but not by much. For example, Tecentriq is priced in Japan at $6,256, versus $6,498 in the US. Similarly, Keytruda is $3,646 in Japan versus $4,342 in the US.

Interestingly, physicians in Japan have a great deal of latitude when prescribing. This suggests that the Japanese market may be promotionally sensitive. Thus, partnering with local companies for both product development and commercialization will be critical for success.

Attractive pricing…openness to innovation…favorable regulatory policies…companies seeking innovation…all of these factors remind us to not forget Japanese companies as potential licensing partners, especially those companies with a long-standing tradition of in-licensing novel drug candidates from the US and Europe. In fact, for companies concerned about CFIUS reconsidering Japan could be a smart alternative for entering the Asian markets.

This article was inspired by a great discussion with Dr. Nagate at BIO in Philadelphia. All data are from MedTrack. Any errors are the responsibility of the author.