Biopharma Dive recently published a series of articles on biotech bankruptcies. The first lists bankruptcies in 2019, while the other lists companies which are teetering towards bankruptcy. As the article notes, bankruptcies in our industry are remarkably rare. But with 11 so far in 2019, and with 6 others in 2018, it makes some sense to look at this further.

While the articles list the companies and provide some history, they fail to take a close look at why these companies faltered. Did they have approved products that performed poorly? Were they unable to raise funds to continue product development? If so, in which therapeutic areas?

So…we decided to take a look ourselves…

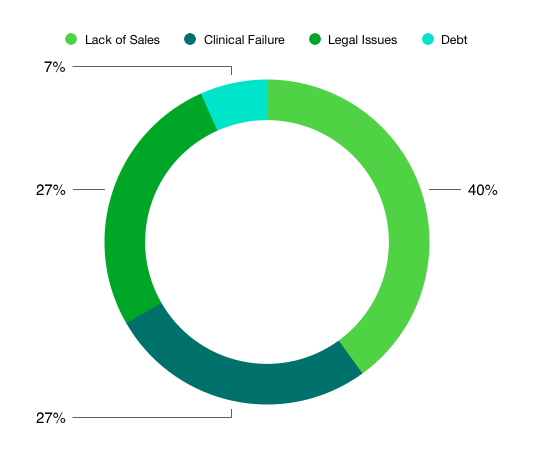

We categorized each bankruptcy in 2019, plus the few potential ones where details are provided, according to the scheme in the chart below. Now the sample size is very small (15 in total). So it is prudent to be cautious when interpreting these data.

However, of the companies listed in the articles, 40% of them actually had approved products on the market. But in these cases, sales were quite disappointing. Multiple therapeutic areas (cardiovascular, anti-infectives, etc.) are represented in this subset, so no definitive conclusion can be drawn.

Over 50% of the companies in the dataset filed for bankruptcy due to Clinical Failures or Legal Issues. For the latter, three out of the four companies (Insys, Purdue, Teva) experienced various legal issues linked to the sale of opioid-based products. The four clinical failures were in various therapeutic areas, but all appear to be late stage (Phase III) failures.

Lastly, one company (Bausch) is at significant risk for bankruptcy due to excessive debt.

So what does this tell us?

Not much with such a small data set. And obviously we are focused largely on listed companies. So the entire exercise is likely undercounting small, private companies that file for bankruptcy without press coverage.

However, the fact that a major portion of these companies had commercially unsuccessful approved products reminds us that product approval is not necessarily a positive conclusion to an undoubtably lengthy development process. Excessive pricing, lack of clinical differentiation, poorly designed clinical trials, and poor sales and marketing can all lead to commercial failures unanticipated (or ignored) by investors.