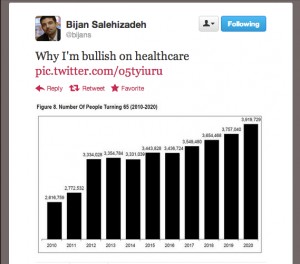

An intriguing graph was posted on Twitter the other day:

Now we understand the argument, and it’s a good one: As the population ages, there will be more long-term illness, which will drive the demand for healthcare (diagnostics, drugs, monitoring, services, etc.).

So from an investor point of view, there will be (hopefully) no shortage of investment opportunities.

We share this enthusiasm, especially since the unmet needs remain very high in oncology, diabetes, COPD, Alzheimer’s, and other diseases associated with an aging population. And it’s not just NCEs that have a monopoly on this bullishness.

Technologies which can drive costs downward will be welcomed, such as biosimilars.

However, as we’ve watched Europe implode, we can’t help but wonder who will pay for all of this innovation?

Let’s not forget…as the population ages, there will be fewer tax-paying workers to support all of this spending.

For an in depth analysis of the “cost” side of the debate, we encourage you to re-visit Mary Meeker’s highly detailed USA Inc. report (very large PDF). Slide 21 itself is rather staggering, where the NPV of Medicaid, Medicare, and Social Security spending as a percentage of GDP is alarming.

Related articles