Nearly 30 years ago, back when your author was a humble pharmacy intern, the first therapeutic to combat HIV (azidothymidine) was introduced by Burroughs Wellcome (now part of GSK).

Back then, companies and celebrities were on television daily, putting pressure on government and industry to develop anti-retrovirals as quickly as possible.

Since then, we have made tremendous progress in turning HIV from an incurable, rapidly progressive disease to one which can be managed for decades.

In fact, the death rate from HIV/AIDS has dropped over 80% since the 1990s, a remarkable achievement to be sure.

Currently, there are approximately 3.5 million cases across the eight major markets, growing at ~2% p.a. Leading products, such as Atripla and Truvada are based on combinations of existing antivirals, thereby reducing pill burden and improving compliance. Positively Aware has a nice chart of currently available drugs indicated for HIV/AIDS.

With these characteristics, has the pharma industry moved away from HIV? Has success caused the industry to shift entirely away from HIV?

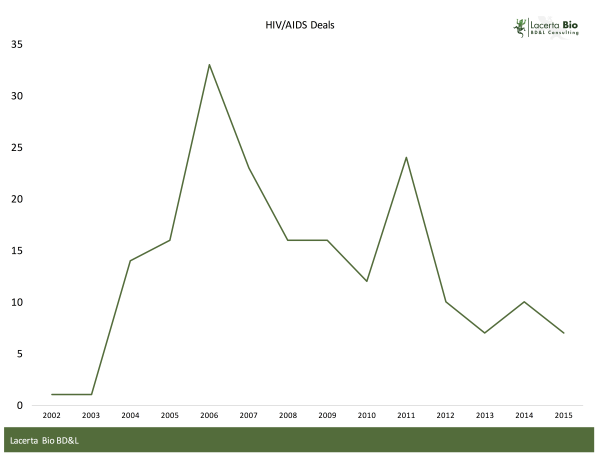

One way to examine this question is to look at licensing activity. To this end, we examined licensing deals in the GlobalData database for HIV / AIDS from 2002 to 2015. Only Completed transactions were included in our analysis. Regrettably, financial terms for most of these transactions were not disclosed.

The database contained a total of 190 completed licensing deals from 2002-2015. To place that into context, in 2015 there were 216 completed licensing deals in oncology alone, up from 192 in 2014.

Licensing activity in HIV peaked in 2006, when Gilead announced licensing agreement with 8 India-based companies to produce generic Viread. Gilead was also very active in 2011, with a similar range of transactions for another product.

Setting Gilead aside, licensing activity has remained flat to declining, and at a relatively low volume.

Do Unmet Needs Persist?

While convenient and compliance seem to be a focus, concern remains about side effects and resistant strains. And, increased screening is a definite unmet need in this market, as some suggest that an incremental 20% or more patients can be identified through more aggressive screening.

Longer-acting parenteral anti-retrovirals would be an ideal way to improve compliance and efficacy.

Another issue which persists in this field is that ~25 million HIV/AIDS patients reside in Sub-Saharan Africa (PhRMA PDF). The region accounts for >70% of all new cases.

Yet the US and Europe bear the economic cost of treating HIV/AIDS, which annual per patient costs exceeding $25,000, a significant amount for what is now considered a chronic, manageable condition.

Lower-cost, longer-acting therapies and vaccines could resolve some of these economic issues. Importantly, resistance remains a key issue which has persisted ever since the disease was first identified.

Lack of Pipeline?

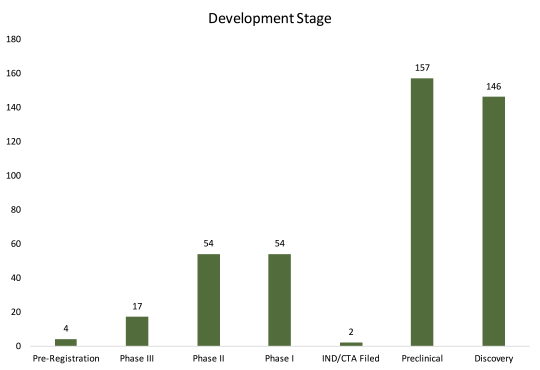

The database has 434 entries of candidates in active development, of which nearly 70% are in Discovery or Preclinical stage. Of those in Phase III, six out of seventeen (35%) are combinations of new and/or existing compounds by leading pharma companies, like J&J, Merck, and Gilead. At a glance, the late-stage pipeline is fairly limited in terms of new drug classes.

Looking at overall pipeline ignores where the industry is investing their resources. Consider the following:

- GSK and Novartis have HIV vaccines in their respective pipelines

- BMS, Merck, and AbbVie have novel antivirals in their respective pipelines

- ViiV Healthcare, a joint venture between Pfizer, GSK, and Shionogi, have a number of HIV assets in its pipeline, including a long-acting integrate inhibitor for prevention

Has Pharma Forgotten HIV?

Clearly not.

What is clear is that pharma’s focus has shifted in response to the market’s needs by agreeing to low-cost generic versions, developing long-acting formulations, developing combinations to improve compliance, and developing vaccines…essentially mirroring the unmet needs in this complex marketplace.

While we as an industry (with government help and support) have made great strides in reducing HIV/AIDS-related mortality, there is still much which can and should be done. Fortunately, the lack of sound bites from the industry over the past few years is not a reflection of a lack of interest or activity. Rather, it is a sharpening of focus which will likely continue to benefit AIDS patients in the foreseeable future.