Much ink has already been spilled discussing the acquisition of Ranbaxy from Daiichi by Sun Pharma in an all stock transaction. A good analysis by a former Ranbaxy executive provides some interesting insights:

The valuation of Ranbaxy is attractive at this point in time when USFDA and regulatory issues are at a peak. And Sun Pharma has been known to purchase companies and turn them around in the quickest possible time. Is it the right time for DS to exit at a loss? This writer doesn’t think so. Why throw in the towel when things can’t get worse? They can only get better.

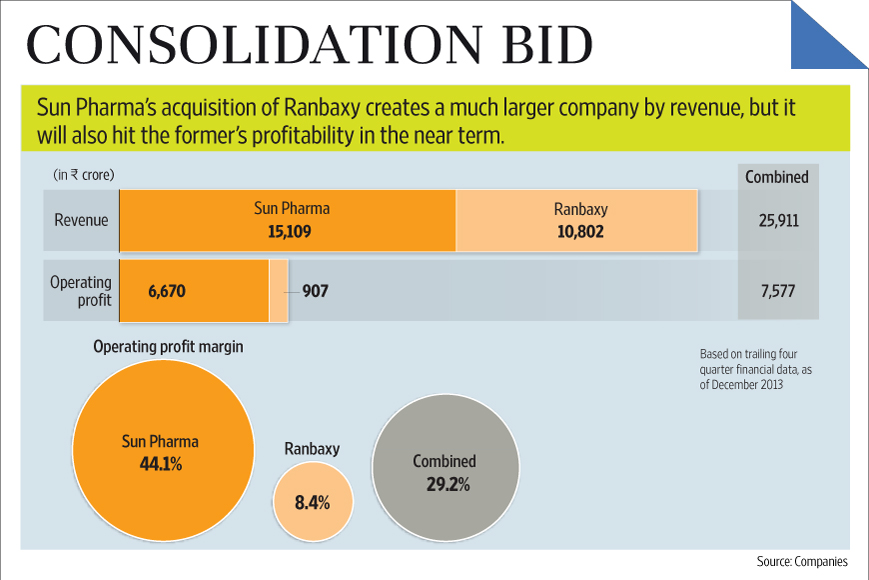

The rationale for the transaction appears to center on a few key points:

- A consolidated entity will compete more effectively in the rapidly growing Indian market.

- Sun has experience turning around troubled companies.

- Sun will focus on resolving Ranbaxy’s US FDA problems…problems which are already well documented here and here.

It’s increasingly clear that the importation of branded and generic products (both Rx and OTC) from India will continue to grow. India is already the second largest exporter of OTC and Rx drugs to the US. Armed with industry fees, the FDA is “blitzing” the Indian pharma industry with inspectors, inspecting three times as many plants in 2013 as the FDA sis in 2009.

With this greater emphasis on inspections comes, of course, a greater number of problems found. For example,

- Apotex banned from exporting from it Bangalore site into the US

- Wockhardt and its long list of QC and other issues (with an amusingly cynical analysis of the Wockhardt situation)

- Sun Pharma itself has experienced import restrictions

The recent trip by our FDA Commissioner to India highlights the importance of the US-India pharma industry relationship…and its challenges:

In my talks with regulators and companies here in India I have placed a great deal of emphasis on why quality matters. As I explained, quality is linked to product safety and without a direct focus on quality, the potential for patient harm increases significantly.

In recent years the FDA has identified significant lapses in quality by some companies operating in the U.S. and around the world. As a result, American consumers have had to endure greater risk of illnesses, recalls, and warnings about the products many of them rely on each day. This is unacceptable. Consumers should be confident that the products they are using are safe and high quality and when companies sacrifice quality, putting consumers at risk, they must be held accountable.

Where does this leave the Indian pharmaceutical industry?

First, with the pendulum swinging towards greater enforcement, the FDA will continue to identify problems with manufacturers in India. Many of these problems will be small and not-widely publicized. But they will be found.

This, in turn, will cause some companies to exit the US market entirely, focusing instead on local markets. We question this approach, since it is a very low margin business strategy of questionable sustainability.

Enforcement & compliance issues will require investments which, in turn, will drive prices of products from India upward.

At what point will India lose its cost advantage?

Related articles