What follows is a true story.

In 2013, we were engaged to out-license a series of Preclinical assets. One of these assets was in a therapeutic area which had very few Big Pharma participants.

So, we did the obvious thing. We targeted multiple people across these Big Pharma companies around the World.

One of them expressed some interest by asking for more non-confidential information, which we quickly provided.

After 3 months, this company asked to enter into a confidentiality agreement with our client.

After some back and forth on the agreement, it was signed by our client, then countersigned by the Big Pharma company.

And then…silence.

Nothing.

No responses to email.

No returned phone calls.

Nothing.

Nearly a year after the confidentiality agreement was signed, an email appeared in our Inbox, asking to re-start the dialogue with our client.

So, as of this writing, our client and the Big Pharma company are in the process of sharing confidential information and asking questions.

Why did it take so long?

Good question…

Let’s All Blame Big Pharma

It is super easy to blame large, multinational companies in situations like this.

We’ve all heard the rhetoric:

- “They” (meaning all large, multinational companies) are bureaucratic

- They are too slow

- They have too many decision makers

- Then don’t have any decision makers

- They change their minds too quickly and frequently

- They never waiver from their search criteria / They lack flexibility

- They get bogged down in details and don’t see the bigger picture

And so forth…

Yes, it’s easy to blame Big Pharma. And why not? They’re an easy target.

And it’s true that some multinational companies are slow to respond.

However, there are other factors at work here which we need to consider (more later).

Newsletter Hype

We think that we are now conditioned to expect deals to be completed quickly due to the misconception that deals happen every day.

After all, if you subscribe to the newsletters, you see deals getting done every day. In fact, the newsletters do reflect this reality.

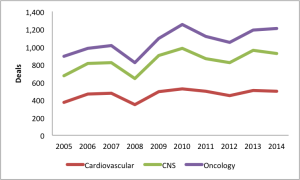

We pulled deal data from GlobalData for three therapeutic areas (CV, CNS, and oncology). For each therapeutic area, we see ~500-1000 deals per year for each category.

Add these up, and that’s roughly 10 deals per working day over the course of a year, year after year.

Ten per day!

So it follows that if they are getting done every day, then they must be getting done quickly, right?

Nope.

What the newsletters don’t tell you is that it can take months and months and months of silence, negotiation, and yes, even bureaucracy to get one transaction completed.

Slow, For Good Reason

Some companies are slow because they perform very thorough, detailed assessments of many opportunities. Importantly, this requires many “hands” to touch an assessment…a process which invariably takes time.

This is a point that many potential licensors forget or do not appreciate. After all, many of them are in small companies, where there are few hands making quick decisions.

But this dynamic simply doesn’t exist is most large companies.

It Not You. It’s Me.

Another source of frustration comes from an underlying denial that an asset is not as commercially attractive as the innovator believes.

As a licensing consultant, it is very difficult to tell a client that the market has spoken and the market is not interested in their asset, for whatever reason (i.e., not innovative enough, not enough data, too expensive to develop, safety concerns, etc.).

It’s as if they come from Lake Wobegon, where all licensing candidates are above average.

In fact, we run into this issue a lot with our business development audits.

And it’s hard…really hard to tell someone their asset is not what they think it is.

Harder still is when that CEO has to face his or her Board. Denial, disbelief, and blame inevitably ensue.

Is This A Good Thing?

Like most things, it’s relative.

If you are that CEO with 6 months cash and no chance of additional financing without a Milestone-heavy licensing deal, then it most definitely is not a good thing.

However, if the vetting process takes a long time because companies want to be absolutely sure (well, as sure as they can be) about an opportunity, then it is a good thing.

Patient due diligence will reduce risk, identify potential speed bumps, and identify areas where more data (and hence, cash) are needed.

This can result in a lengthy process, but one which can yield better, safer, more effective therapies on the market.

What To Do?

We’ve made suggestions in the past (and here) on key areas companies can improve when out-licensing. Some of them are fairly basic, like having data-driven market opportunity assessments and forecasts.

But fundamentally, it is simply a rare occurrence when a licensing process can be completed in 6 months.

These things take time, irrespective of the quality of the asset or the presentation, or what the press is saying about the next “hot” technology.

If your asset/opportunity is truly remarkable, then a partner can be found.

It just takes time, and you (and your Board) should be prepared for this lengthy process to unfold.