In our last post, we presented a model which helps us aggregate a series of variables which, in turn, help us understand why certain therapeutic areas or indications are of greater interest from a licensing perspective than others.

Our aim with this model is to help companies with licenseable assets to frame their “stories” in a way which is compatible with how potential partners approach evaluation and decision-making.

Our first attempt at applying this model is for the HIV/AIDS market. During the 1990s, stories about AIDS were a daily occurrence on the nightly news. Images of celebrities fighting and dying from AIDS seemed to be everywhere. Rock Hudson, Freddy Mercury, Anthony Perkins…the list of celebrities who succumbed to complications from this disease seemed endless.

But what about today? Are there Unmet Needs which can be satisfied via novel therapeutics? And, if so, are they being funded and developed? Are there multinational companies with a stated interested in licensing these innovations once they are sufficiently mature?

In this post, we take a look at these questions.

Commercial Attributes

Beginning with the launch of azidothymidine by Burroughs-Wellcome in 1990, academia and industry responded with a steady stream of new candidates with novel mechanisms of action. The history of AZT is actually quite interesting, as it was initially believed to be a good candidate to treat cancer by blocking nucleic acid synthesis.

Today, the global HIV therapeutics market is approaching $15 billion, primarily in the US. Complex, multi-product regimens are being simplified with the development of single-tablet regimens and fixed-dose combinations, thereby improving compliance and overall efficacy. For many patients, AIDS has changed from near-term, assured mortality to a disease which can be managed for decades, making it one of the few chronic infectious diseases known. Genericization of many older products is reducing the overall Market Size CAGR to <1% p.a.

Yet with the rapid level of pharmaceutical innovation against HIV, prevalence remains high, and growing at surprisingly rapid rates in several “Western” countries. India and South Africa are becoming countries with large populations of HIV positive patients.

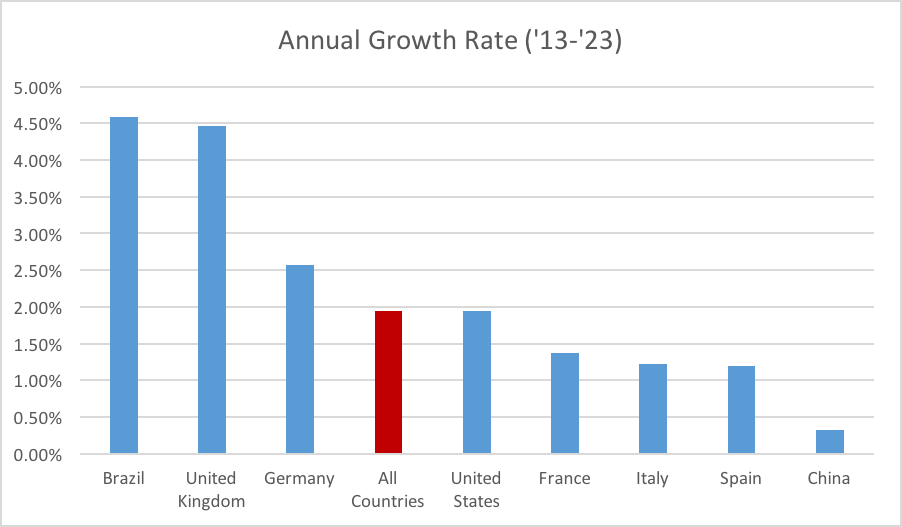

The prevalence of treated AIDS patients varies substantially from country to country, with Brazil and (surprisingly) the United Kingdom leading the way. Outside the traditional major pharmaceutical markets, however, is where the numbers become scary. For example, the HIV Prevalence in India is “only” 0.3%. But due to the large population, that translates to over 2 million people living with HIV, which is nearly half the total of the HIV prevalent population in the 8 major markets combined. The fraction of these patients who are actively treated is uncertain.

Figure 1: Treated AIDS patients in the 5 major EU markets, plus the US, Japan, China, and Brazil. Note that other major AIDS populations, such as India and South Africa, and not included.

Then there is South Africa, the country with the largest HIV population. As of 2013, South Africa has over 6 million people living with HIV, which is a prevalence of 19%. The Incidence rate of 330,000 new infections per year is roughly the same as the total prevalence of Italy, Spain and the United Kingdom combined. Fortunately, the South African Federal government is investing over $1 billion per annum to fight AIDS.

Figure 2: Prevalence growth rates, by country.

We should also note that a significant percentage of persons infected with the HIV virus are unaware, or are aware but not being treated. Estimates for this disease ignorant & untreated population vary, but 50% is a reasonable estimate. This is a critical issue because undiagnosed and untreated people with HIV may be responsible for 90% of new infections.

Globally, we are looking at a prevalent population approaching 40 million, of which approximately half are unaware they are infected. Further, approximately half of the prevalent population lack adequate medical care. While some of these countries are not financially attractive for multinational companies, they do represent a constant source of new infections. Hence, the problem of HIV and AIDS will not disappear anytime soon.

Unmet Medical Needs

Industry, academia, patient advocacy groups, and government have done a remarkable job in understanding this unique virus, developing therapies, increasing awareness, and promoting prevention. Readers will recall that when AIDS was first being diagnosed, patients could only expect to live 10 years or less after infection. Meanwhile, as the Prevalence continues to rise, death rates for HIV-positive patients have been declining for several decades.

For an overview of the treatment of AIDS and its many associated illnesses, we refer you to this overview in the Merck Manual. This entry discusses the six different classes of anti-retrovirals, combination products, etc., etc. A short primer on HIV vaccines in development is available here.

So while AIDS remains a problem with no effective solution in sight, progress has definitely been made in a relatively short period of time. Effective antiretroviral therapies, coupled with increased awareness of the importance of overall health (such as reduced smoking), is driving this trend. Now, physicians advise their patients that a normal life span is possible if treatment is continued as prescribed, especially for patients with an early diagnosis. Indeed, we may have reached the point that “clean living” has resulted in many AIDS patients outliving their otherwise healthy peers. But again, life expectancy correlates with early diagnosis.

From Abacavir to Zidovudine

There are over 100 marketed products available for the treatment of HIV/AIDS. Many of these products are multi-drug combinations, such as abacavir + lamivudine, abacavir + lamivudine + zidovudine, abacavir sulfate + lamiduvine ODT, etc. Four products are four-drug combinations, while another sixteen are three-drug combinations. Forty percent of the products listed are combinations of two or more drugs.

So while there have been many successes, major unmet needs remain:

Vaccines – The history and status of HIV vaccines would require many pages to discuss. Initial summaries can be found here, here, and here. The most advanced HIV vaccine is about to start a very large Phase IIb/III trial in South Africa. This trial aims to enroll 5,400 uninfected subjects who are at risk for HIV infection. Results are not expected until 2020. It is unlikely that this vaccine will be 100% effective at preventing HIV infection. Indeed, studies with previous vaccines suggest a 60% prevention rate one year after vaccination would be considered a success. Both Sanofi Pasteur and GSK are involved in a private/public partnership to develop HIV vaccines.

Simply put, the challenges associated with the development of an HIV vaccine are tremendous, many of which with no easy solution:

• Live, attenuated, viral vaccines are not advisable due to the risk of reinfection;

• Good animal models for human HIV remain elusive;

• Retrovirus can “hide” by incorporating their genome onto ours, so complete elimination of infected cells may be impossible;

• Favorable pricing and reimbursement for a modestly successful vaccine will be challenging.

Greater Physician & Patient Awareness – Now that AIDS and HIV is no longer in the news as it once was, awareness of the disease has actually declined. According to the CDC, 44% of HIV positive individuals 18-24 years of age do not know they are HIV positive. Perhaps it is the good news about declining cases of HIV infection which is relegating this to a disease of the past. Indeed, HIV infection is no longer the death sentence that it once was. But, we note that a) disease prevalence is growing globally, and b) regional reductions in incidence do not translate to disease eradication, which should be the goal of any infectious disease program.

“We’ve gotten to a point of complacency when we think about HIV and AIDS,” said Dr. Bertram Jacobs, director of the School of Life Sciences at Arizona State University and a professor of virology. “We don’t think about it because we don’t have people dying all the time like we did in the 1980s and early ’90s.”

Resistance – Like any other infectious disease, the probability of resistance developing in the presence of antiretroviral therapies is high. Yet the prevalence of resistance is falling, especially in the US and Western Europe. Using multiple classes of antiretrovirals reduces the chances of developing resistance, but the chance remains.

Innovation

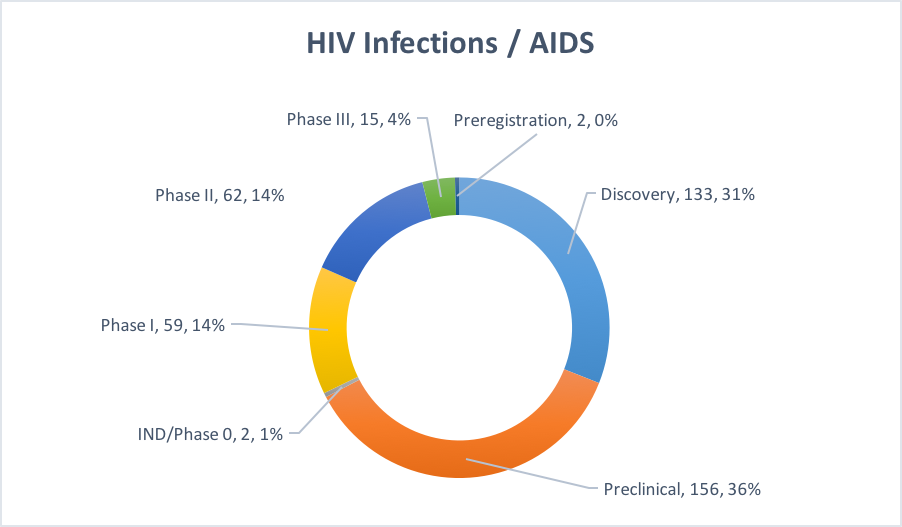

Figure 3: Pipeline for HIV / AIDS therapies.

Phase III: Of the 15 programs in Phase III, four of them are combinations of various existing antivirals developed by multinationals (J&J, ViiV, and Merck). Eleven out of the fifteen are small molecules. It is unclear if any of these will have a dramatic impact on how HIV/AIDS is currently treated.

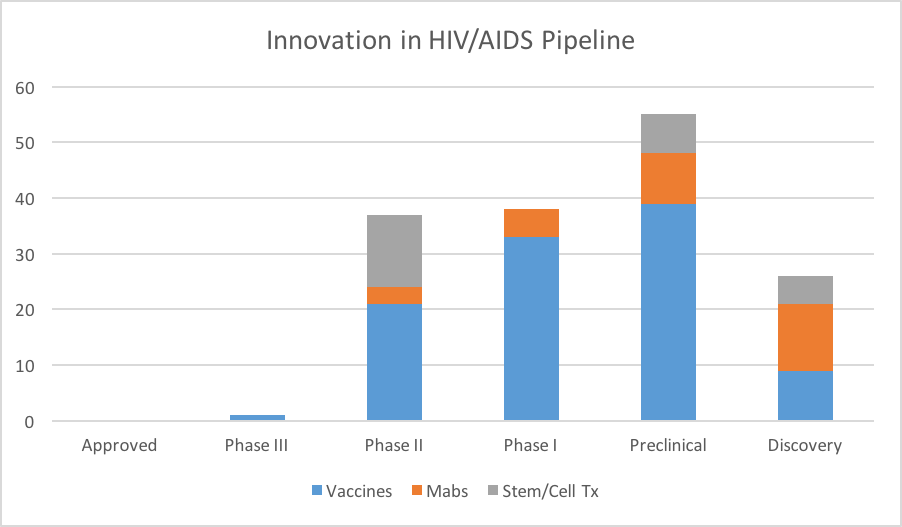

Phase II: There are 21 vaccines and 13 cell therapy programs in Phase II. Big Pharma has a significant presence in vaccine development, with Johnson and Johnson, GSK, Sanofi Pasteur, and others sponsoring development programs. Cell therapies and monoclonal antibody approaches are also being explored in the clinic, with the latter targeting the CD4 binding site of gp120.

Phase I: Nearly 60% of the Phase I programs are vaccines. A cursory glance suggests that the majority of these programs are driven by small companies and universities, although Merck appears to have at least two Phase I vaccine programs in their pipeline.

Discovery and Preclinical – There are nearly 300 programs at this early stage of development, and they include small molecules, peptides, vaccines, and cell and gene therapies.

Looking across the pipeline, we can see that many early-stage programs are quite innovative, in the sense that these programs offer something quite different from what is already on the market. This certainly bodes well for AIDS patients. But we still remain many years away from a fraction of this early-stage pipeline coming to fruition.

Figure 4: Selected categories of innovative therapies for HIV/AIDS in development.

Licensing Activity

On the surface, it would appear that the HIV/AIDS market is ripe for innovation by our industry:

¬ Growing patient population in Western markets

¬ Unmet needs which can be addresses pharmacologically

¬ A chronic condition with numerous complications which emerge as disease progresses

¬ Drug resistance which lends itself to novel drug discovery

¬ Increasing levels of publications on HIV

¬ Tremendous amount of innovation, especially in Phase II and earlier

Given this backdrop, how has the industry reacted from the licensing and fundraising perspectives? Has licensing activity grown? Declined? And, if it has declined, why is this the case?

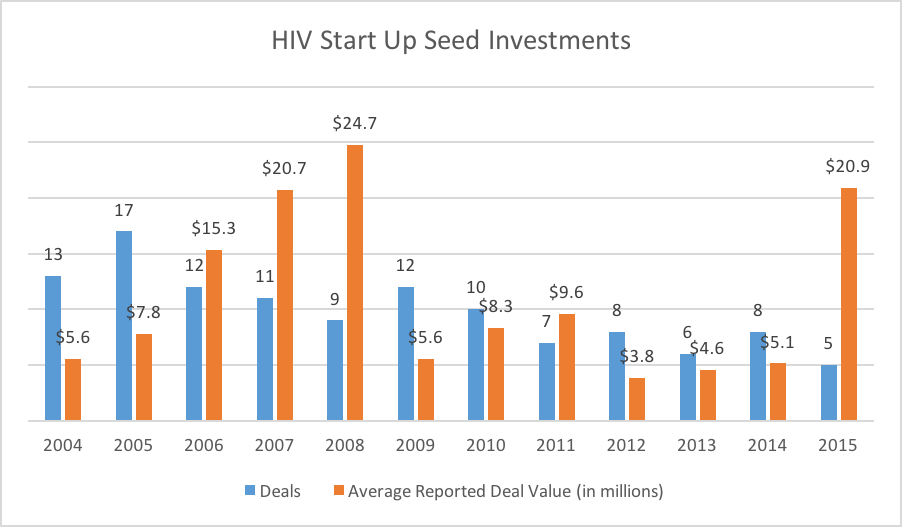

Figure 5: Completed Start up & Seed investments in HIV companies. Not all deal values were reported.

Figure 5 shows the trend in seed & start-up investments (and announced deal sizes) from 2004 through 2015. After peaking around 10 years ago, the number of annual early-stage investments has decreased and remained relatively low. We should also note that few, if any of these companies are 100% dedicated to HIV drug discovery. For instance, that spike in 2015 is driven by a $56 million Series A round raised by Atreca. The company has a broad pipeline in both oncology and infectious disease. Further, their infectious disease pipeline is divided between malaria and HIV. In other words, the actual dollars shown here are not completely dedicated to HIV research, and therefore should be interpreted accordingly.

Figure 6: Completed Licensing and Joint Venture deals. Very little financial information as disclosed, and hence not included.

Figure 6 shows the completed licensing and joint venture deals in HIV/AIDS. Again, we see a peak occurring around 10 years ago, followed by a decline. Interestingly, we have already seen 18 licensing/joint venture deals completed in 2016. Scanning the list of companies involved in these deals, approximately 1/16 in 2016 involve a multinational pharma company. For 2015, it is 4 out of 17.

This suggests that the industry has perhaps already licensed the most promising technologies from the 2006-2011 window. Meanwhile, the more innovative assets in Phase I or earlier are awaiting further maturation before being licensed, if at all. Interestingly, a search of the partnering360 database shows 32 HIV/AIDS assets listed as available for licensing, but no companies with a stated interest in in-licensing in the HIV/AIDS area.

So why would a company choose not to participate in this therapeutic area via in-licensing?

Launching into Generic Market – Heavily genericized markets can be difficult to penetrate with new products without exceptional clinical data, substantially different mechanisms of action, or alternative route of administration which changes how medicine is practiced for that particular indication (and sometimes all of the above). This is a phenomenon we see on many other therapeutic areas and indications, such as hypercholesterolemia, antibacterials, and chronic pain. With multi-drug combinations becoming more common, and eventually generic, it will take new approaches (such as vaccines) to trigger renewed, aggressive in-licensing. However, vaccine trials are exceedingly difficult, and relatively few companies have the expertise to manage these complex trials.

Blatant Patent Violations – In 2001, the Brazilian Health Minister asked a local pharmaceutical company to begin manufacturing a generic version of nelfinavir (Roche), in an attempt to reduce the cost associated with AIDS therapy. This move was repeated in 2007 for efavirenz (Merck), a move which would save the government nearly $50 million per year until the full generic version was available. It should not surprise us if companies choose not to participate in a therapeutic area where patents are not respected, especially in key markets.

Shift to Vaccines – The market, as viewed by the pipeline, will shift towards vaccines eventually (whether these new vaccines are effective enough to garner widespread use is an open question. We speculate that many companies will simply move to other markets in order to avoid the complexities associated with vaccine development. Once other companies successfully commercialize vaccines, however, it is possible that some M&A activity will be used to acquire the assets and skills required for the development and commercialization of HIV vaccines.

Conclusions

With 100 products on the market, pharma companies are already engaged in a battle for share and TRx. The first wave of innovation came in the form of a variety of anti-retroviral mechanisms of action, which are now being combined in multi-drug products. Future therapies will be quite different. However, if these multi-drug combinations (which will eventually be available as generics) are able to keep patients alive for decades, will novel, expensive therapies have a place? Will the market simply be too small (and development too costly) for these therapies to ever make it to market? This is our concern, as it resembles what is already happening in other therapeutic areas, such as pain and antibacterials.

For companies looking to out-license early-stage assets in the HIV/AIDS space, it may be difficult if the asset in question is another oral small molecule, unless it demonstrates clear superiority in head-to-head trials. As most companies eschew those kinds of trials, other evidence of superiority will be required, especially as effective, multi-drug combinations become generic.

For companies developing therapies, such as vaccines, monoclonal antibodies, stem cells, gene therapies, and other, more exotic approaches, the future is potentially bright. However, unique patient subsegments may be required in order to create highly attractive ROI arguments for potential licensees.