Ophthalmology is changing.

If we look back 5-10 years, topical formulations of novel or established drugs were the norm in ophthalmology product development.

These days, we are seeing antisense, gene therapies, and even cell therapies being developed and licensed for ophthalmology applications.

But is this a true trend, or are the headlines simply giving this impression?

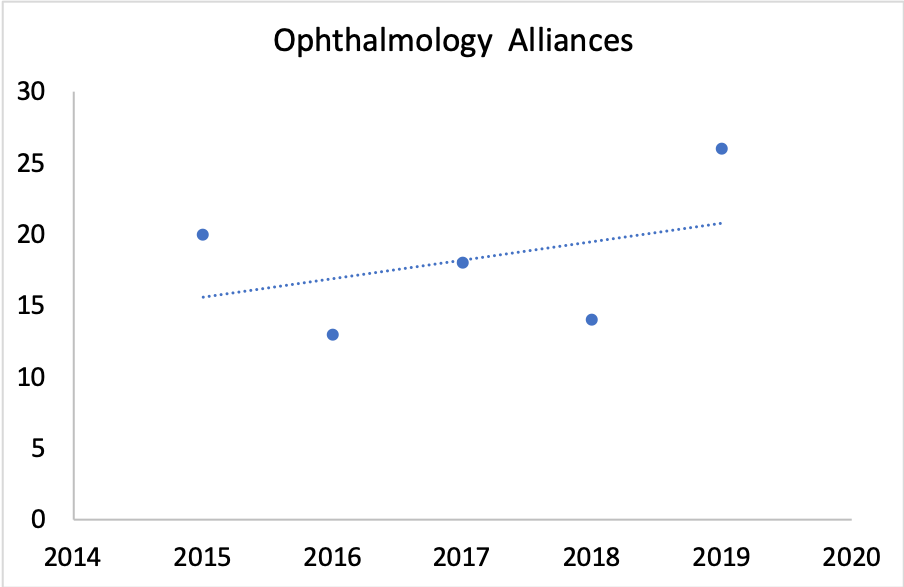

Alliances in Ophthalmology

According to BioMedTracker, “alliances” in ophthalmology have steadily increased over the past decade or so.

There are obviously epidemiological drivers at work here (aging population, etc.). But a big driver is a shift in the types of therapies being developed for the eye, coupled with an increased willingness to perform intravitreal injections.

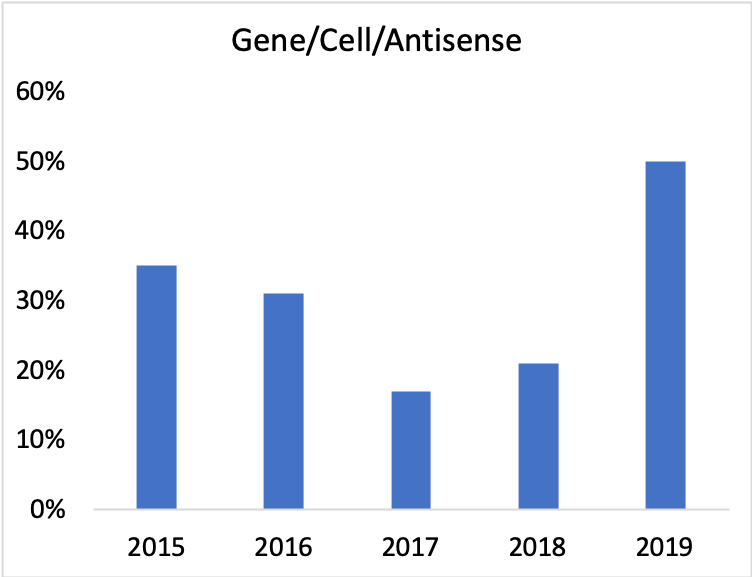

Technology

According to Biomedtracker, 2019 saw 50% of all ophthalmology alliances involve gene therapy, cell therapy, or antisense. Admittedly we are looking at a large percentage of a small number.

But considering that <25% of alliances in 2009 involved these kinds of therapies, we’ll go out on a limb and call this a positive trend.

Looking at the partnerships from 2019, a few interesting alliances caught our eye:

Samsung Bioepis & Biogen – Samsung licenses two biosimilars (ranibizumab and aflibercept) to Biogen which are used in a variety of ophthalmic conditions, for $310 million in Upfront and other payments.

Copernicus & Wize – Ohio-based Copernicus Therapeutics licensed non-viral gene therapies to Wize Pharma. These therapies consist of non-viral DNA nanoparticles to treat the rare disease Choroideremia.

MeiraGTx & Janssen – Janssen licensed several gene therapies for the treatment of X-linked retinitis pigmentosa and achromatopsia, both inherited (and rare) retinal diseases.

These and others are interesting because they use rather complex therapeutic modalities to treat rare conditions or we see biosimilars aimed at capturing share via lower price (classic Porterian strategy).

What about small molecules?

Combining established molecules with novel delivery systems still have a great deal to offer patients with a wide range of ophthalmic conditions. For example, MA-based Kala Pharmaceuticals is developing a candidate which combines a steroid with their proprietary mucosal penetrating product technology for dry eye disease.

Also, in July of 2019, the US FDA accepted Allergan’s NDA for a sustained release implant of the prostaglandin bimatoprost. This sustained delivery of a prostaglandins promises to resolve the patient compliance issue frequently seen in glaucoma, ultimately resulting in better clinical outcomes.

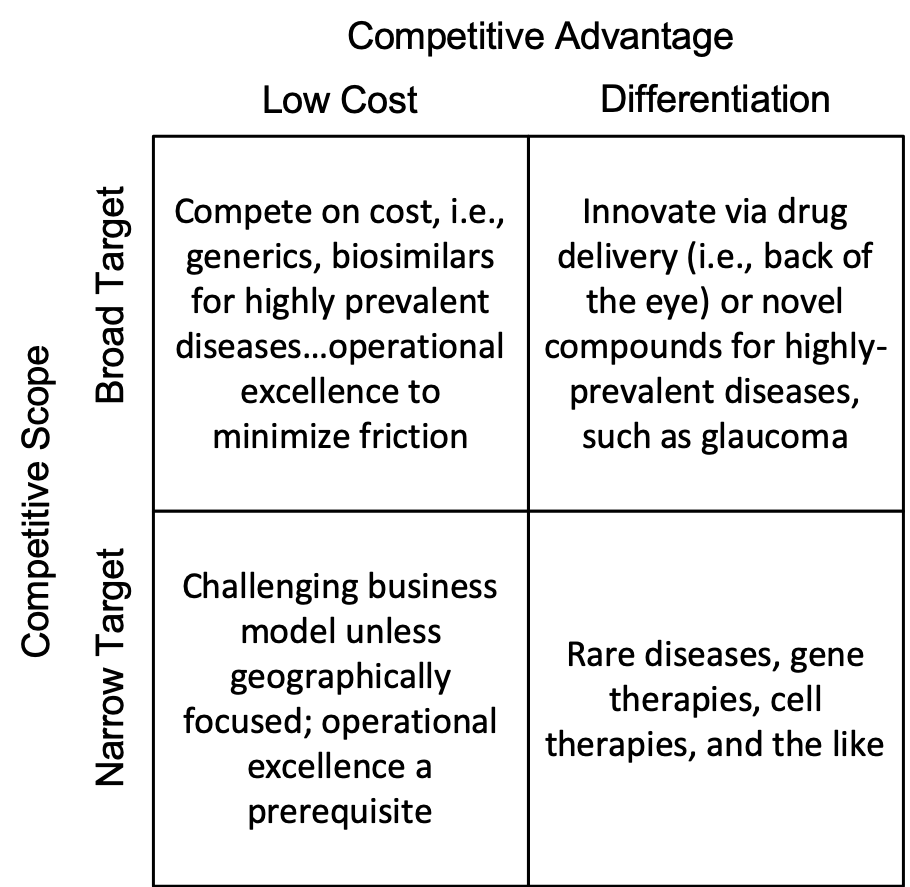

Generic Strategies in Ophthalmology

So where is the ophthalmology market going? More specifically, which strategies make the most sense?

Broad Target/Low Cost – Ophthalmology is an obvious area for biosimilars to compete on cost versus their branded brethren and each other. The Samsung/Biogen alliance was not the first, and it won’t be the last.

Broad Target/Differentiation – Ophthalmology continues to be an area where drug delivery approaches can play a major role in eye diseases beyond improvements in compliance. Back-of-the-eye delivery continues to be both a challenge and an area rich in research and promise. However, aside from the recent approval of netardusil, we have seen little in the form of novel small molecules for the more highly prevalent indications, a problem not unique to ophthalmology.

Narrow Target/Low Cost – An extremely challenging business model to execute profitably, although national/regional companies can do this, and do it well.

Narrow Target/Differentiation – It is obviously a good trend to see such innovation being applied to rare diseases. However, cost and safety concerns will always be an issue with these approaches.

So where is ophthalmology going?

As a therapeutic area, one can argue that opthalmology is much more innovative than most others.

While the number of alliances may appear small, the sophistication of the modalities being licensed, coupled with a strong presence of both biosimilars and drug delivery, is unique in our industry outside of oncology.

Indeed, as we see in oncology, we would expect more of the same in the years ahead (biosimilars, rare disease therapies, etc.).

A rather challenging problem that remains is retinal neuroprotection with small molecules, a topic that will be covered in a future post.

And now...a word from our Sponsor

Attending BIO2020 this June?

Consider sponsoring our Sunday Primer!

We are expecting ~200 BIO attendees at The Field on Sunday, June 7 for a few hours of free food and cheer.

Two sponsorship levels are available for this event:

Silver Level – Digital marketing of your company logo and link to our newsletter recipients, LinkedIn contacts, and a presence at the event.

Gold Level – Silver, plus time on the microphone at the event, and free tickets to the Wednesday Charity Gala.